three. Most likely Versatile Repayment Solutions: Some payday lenders supply solutions like installment designs or extensions for borrowers having difficulties to meet repayment deadlines. When not universally accessible, these can offer added relief.

In case you’d prefer not to make use of credit history to address an unforeseen Invoice or urgent price, these alternate options to unexpected emergency loans could perform as an alternative.

Far better for Cardholders with accessible credit who have to entry a little number of funds and will pay for to pay for it back speedily.

If you want a pawnshop personal loan, the pawnbroker will likely not pull your credit score but in its place give you a financial loan based upon the worth, problem and resale possible of your respective item. The quantity you can get mainly is dependent upon the pawnshop, which could lend as minor as twenty five% or approximately sixty% of the merchandise's resale worth.

Views expressed Listed here are writer’s alone, not Those people of any lender, bank card issuer or other organization, and also have not been reviewed, authorized or otherwise endorsed by any of those entities, Until sponsorship is explicitly indicated.

Just how much Will Borrowing Charge Me? Paydayloanspot.com does not increase services prices. We link borrowers that has a lender, and we won't ever charge costs. However, your lender may well include additional expenses if accepted for the personal loan and take the present.

What is “Yearly Proportion Charge” – APR? Our individual mortgage lenders perform nationwide and constantly seek to give you the money you are trying to find. These mortgage solutions have at least 61-day plus a greatest of 72-month repayment terms.

Your lender will be aware of any federal protections or packages offering additional aid to borrowers because of the pandemic.

When repayment is missed, you could possibly end up rolling over the personal loan, incurring more costs and curiosity, and most likely falling into a cycle of financial debt.

"Payday loans can get you into a cycle of getting out a fresh bank loan to pay back the previous financial loan, as well as curiosity fees are incredibly higher," says Amy Lins, vice president of client good results at Dollars Administration Global, a nonprofit credit rating counseling agency. "A pawnshop mortgage could find yourself costing a good deal If you cannot redeem the merchandise plus the pawnshop sells it."

The fund will also connect grocery staff with nearby sources as a result of 211. When you are wanting support Just click here to use.

three. Adverse Influence on Credit rating Scores: Late payments or defaults are reported to credit history bureaus, which can hurt your credit history score. In addition, unpaid loans may very well be sent to collections, further damaging your fiscal standing.

Creditors can be willing to work with you to regulate payment conditions or offer you a temporary forbearance if you check with. This tends to aid minimize economic tension devoid of incurring the significant more info costs of payday loans.

"They would be the the very least highly-priced or even only option for some people with lousy credit score to obtain a personal loan," suggests Erik Carter, a Qualified fiscal planner with Financial Finesse, a workplace economic training company.

Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Erik von Detten Then & Now!

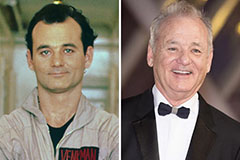

Erik von Detten Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!